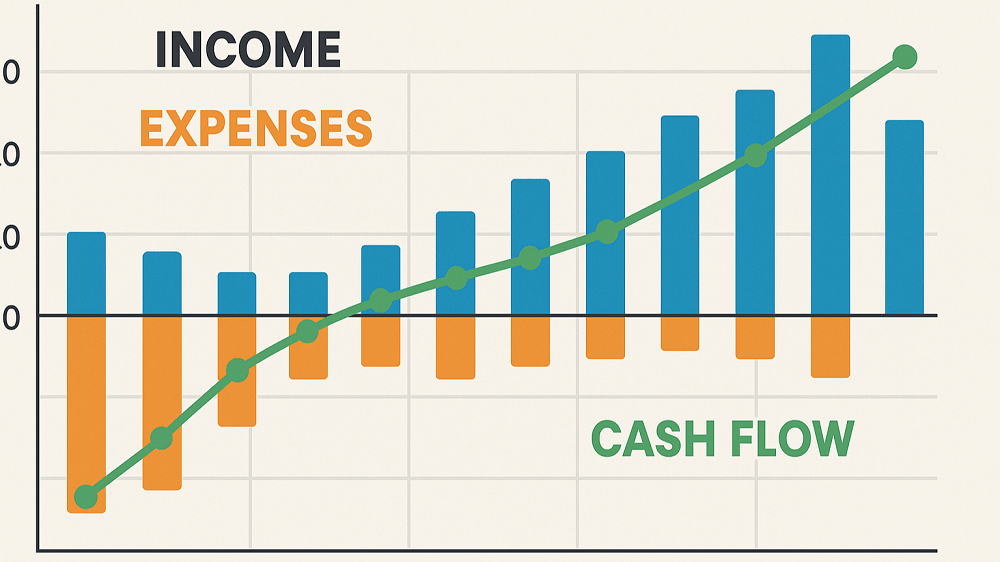

Understanding your cash flow statement is crucial for small business owners. Cash flow is the lifeblood of your business, and without it, even profitable businesses can struggle. But many entrepreneurs overlook their cash flow statement or find it confusing. Knowing how to read and interpret this financial document can help you make smarter decisions, avoid cash crunches, and ensure your business stays healthy.

What is a Cash Flow Statement?

A cash flow statement is one of the three primary financial statements used to track a business’s financial health, along with the balance sheet and income statement. The cash flow statement tracks the movement of cash in and out of your business, showing where your cash is coming from and where it’s going.

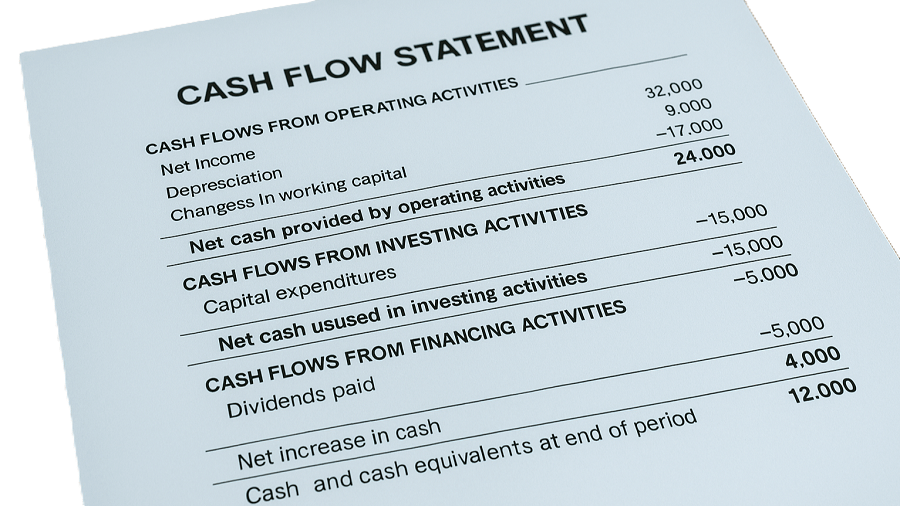

The statement is divided into three key sections:

- Operating Activities: Cash generated or used from daily business operations.

- Investing Activities: Cash spent or earned from buying and selling assets like property or equipment.

- Financing Activities: Cash raised through loans or capital investment, or cash used to pay back debt or distribute dividends.

Understanding these categories can help you see how well your business is performing and where improvements are needed.

Why is a Cash Flow Statement Important?

A cash flow statement is a vital tool for small business owners for several reasons:

- Predicts future cash flow: By analyzing past cash inflows and outflows, you can predict future cash needs and avoid surprises.

- Shows profitability vs. liquidity: It helps you see whether you’re making money on paper but still running low on cash. Many businesses are profitable but lack the liquidity to cover short-term expenses.

- Helps with decision-making: Knowing your cash flow gives you the information you need to decide whether to invest in new opportunities, hire employees, or cut costs.

- Ensures solvency: It helps you track whether your business can meet its short-term obligations, such as paying employees or suppliers.

- Prevents financial trouble: A poor cash flow position can signal bigger financial problems. By catching it early, you can address issues before they grow.

While the income statement can tell you if your business is profitable, the cash flow statement gives you a clearer picture of whether you’re actually able to pay your bills.

The Three Sections of a Cash Flow Statement

Now that you understand what a cash flow statement is and why it’s important, let’s dive into the three main sections that make up the statement.

1. Operating Activities

Operating activities include the day-to-day business operations that generate revenue and incur expenses. This section helps you determine whether your core business is producing enough cash to cover its operations.

Key components in this section:

- Net income: The starting point of the operating activities section is your business’s net income (from the income statement). This is the profit your business has made after all expenses.

- Adjustments for non-cash items: This includes things like depreciation or changes in working capital. These are accounting adjustments that don’t affect cash but are reflected in your income statement.

- Changes in working capital: Working capital is the difference between your current assets (like inventory and receivables) and current liabilities (like payables). If you’re increasing inventory or offering more credit to customers, it will affect your cash flow.

Example:

If your business made a net profit of $50,000 last month but saw a decrease in accounts payable (i.e., you paid more of your bills), your cash flow from operating activities may show a smaller number than $50,000, because cash went out to pay for operating expenses.

2. Investing Activities

Investing activities include transactions related to long-term assets, such as property, equipment, or securities. This section shows how much cash is being spent or generated through investments in assets that support the long-term growth of your business.

Key components in this section:

- Purchasing or selling assets: Cash spent on buying equipment, property, or investments (or cash received from selling assets) will be tracked here.

- Loans or investments: Cash spent on or received from lending or borrowing money for long-term investment purposes is also recorded here.

Example:

If you spent $20,000 to buy a new piece of machinery, that would show as a negative cash flow in investing activities. Conversely, if you sold an old piece of equipment for $10,000, that would show as a positive cash flow.

3. Financing Activities

The financing activities section shows how your business is funded and how it repays debts. This section tracks the flow of cash between the business and its investors, lenders, and owners.

Key components in this section:

- Issuing or repaying debt: Any loans you take out or pay off will show in this section.

- Issuing or buying back stock: If you raise capital by selling equity or buy back shares, this will be recorded here.

- Dividends: Cash paid to shareholders in the form of dividends is shown here.

Example:

If your business takes out a $50,000 loan, that would show as a positive cash flow in financing activities. On the other hand, if you repaid a portion of your loan, that would show as a negative cash flow.

How to Read and Interpret Your Cash Flow Statement

Once you understand the components of a cash flow statement, it’s important to know how to interpret it and use it to make decisions. Here’s how to approach reading the statement:

1. Analyze Your Operating Cash Flow

The most important section of the cash flow statement for most small business owners is the operating activities section. This shows whether your core business operations are generating sufficient cash.

- Positive operating cash flow: If your operating cash flow is positive, it means your business is generating enough cash from its operations to fund its daily activities. This is a good sign that your business is financially healthy.

- Negative operating cash flow: If the operating cash flow is negative, it means your business is losing money on a regular basis. You might need to adjust your pricing, reduce expenses, or increase sales to improve your cash position.

2. Understand Investing and Financing Cash Flow

While operating cash flow tells you about the day-to-day health of your business, investing and financing activities give you a bigger picture.

- Investing activities: If you’re spending a lot on assets (like equipment or property), that could mean you’re investing for future growth. But it’s important to balance that with generating enough operating cash flow to cover those expenses.

- Financing activities: If you see a lot of cash coming in from loans or investors, it could mean you’re taking on debt to fund growth. However, excessive debt could lead to long-term financial challenges if not managed properly.

Common Pitfalls to Avoid When Interpreting Cash Flow

Even experienced business owners sometimes make mistakes when reading their cash flow statement. Here are a few common pitfalls to avoid:

- Focusing only on net income: Net income is important, but it doesn’t show the full picture. Cash flow includes non-cash transactions, such as depreciation or changes in working capital. Always look at the entire cash flow statement, not just the bottom line.

- Ignoring seasonal fluctuations: If your business has seasonal ups and downs, keep that in mind when interpreting cash flow. A negative cash flow in the winter might be normal for a ski shop but alarming for a year-round business.

- Overlooking future cash needs: A positive cash flow today doesn’t mean you’re in the clear. Always plan for future expenses and make sure you’re saving enough to cover upcoming costs.

Final Thoughts: Using Your Cash Flow Statement for Better Decision-Making

Reading a cash flow statement may seem intimidating at first, but it doesn’t have to be. Once you understand the three main sections and learn how to interpret key figures, you’ll gain valuable insights into your business’s financial health. This information empowers you to make smarter decisions, whether it’s improving operations, adjusting your strategy, or planning for future growth.

Regularly reviewing your cash flow statement ensures your business stays on track and helps you avoid financial surprises. By getting comfortable with this important tool, you can make more informed decisions and set your business up for long-term success.