Starting or growing a business takes more than a good idea. It takes capital. For many small business owners, the first instinct is to go to the bank. But what happens when that loan application is denied. Or when you just want to avoid debt altogether?

There are plenty of smart ways to fund your business without a bank loan. Whether you are just launching or looking to expand, this guide will walk you through real, practical options that don’t involve sitting across from a loan officer.

Why You Might Want to Avoid Bank Loans

Bank loans can be a great option for the right business, but they’re not always accessible or ideal. Here are some of the most common pain points business owners face:

- Strict approval criteria: Banks often require high credit scores, collateral, and years of financial records

- Long application processes: Weeks of paperwork, waiting, and uncertainty

- Rigid repayment terms: Fixed monthly payments even if your income is seasonal or unstable

- Risk of personal guarantees: Many loans require you to put your personal assets on the line

Avoiding these pitfalls is one reason many entrepreneurs look for more flexible, creative ways to get the funding they need.

Option 1: Bootstrap Your Business

Bootstrapping means using your own savings, revenue, or assets to fund your business. It’s one of the most common ways small businesses get started.

Benefits:

- You keep full ownership and control

- No debt to repay

- You build discipline from day one

Best for:

Lean startups, service-based businesses, or side hustles with low overhead.

Tips:

- Start small and scale up

- Use free or low-cost tools

- Reinvest early profits back into growth

- Limit personal financial risk by setting a cap on how much you’ll invest

Bootstrapping requires discipline, but it keeps you in the driver’s seat.

Option 2: Tap Into Friends and Family (With a Plan)

Borrowing from friends or family can be risky if not handled professionally. But with clear agreements and honest communication, it can be a low-cost and supportive way to get started.

How to do it right:

- Treat it like a real business transaction

- Put terms in writing, even if it’s informal

- Offer a timeline for repayment or outline how they’ll get a return

- Consider equity or profit-sharing if appropriate

Best for:

Early-stage funding or bridge financing when cash is tight.

Keep relationships strong by being transparent and reliable.

Option 3: Apply for Small Business Grants

Grants are essentially free money. Unlike loans, you don’t have to repay them. The catch? They’re competitive and require a solid application.

Sources of grants include:

- Federal and state government programs (like SBIR, USDA, or minority-focused grants)

- Local economic development agencies

- Nonprofits and private foundations

- Corporations with small business support initiatives (e.g., FedEx, Visa, or Shopify grant programs)

Tips for applying:

- Make sure you meet the eligibility criteria

- Follow the application instructions exactly

- Clearly describe your business impact or innovation

- Track application deadlines and requirements

Best for:

Businesses with a unique story, social mission, or innovative product.

Visit Grants.gov or SBA.gov to explore your options.

Option 4: Use Crowdfunding to Rally Support

Crowdfunding platforms allow you to raise money from the public in exchange for rewards, early access, or equity. It’s part marketing, part fundraising.

Popular platforms include:

- Kickstarter (for product launches and creative projects)

- Indiegogo (flexible for a wide range of businesses)

- GoFundMe (best for personal or community-driven causes)

- Wefunder and StartEngine (for equity crowdfunding)

Keys to success:

- Have a compelling story and mission

- Create a video or demo to showcase your product or idea

- Offer meaningful rewards or incentives

- Promote the campaign actively through your network and social media

Best for:

Consumer-facing products, community-based projects, or early product validation.

Crowdfunding not only raises money but also builds buzz and loyalty.

Option 5: Find a Strategic Partner or Investor

Sometimes the best funding comes from someone who sees value in being part of your business and not just lending money.

Options include:

- Angel investors: Individuals who invest their own money, often in exchange for equity

- Strategic partners: Vendors, suppliers, or industry allies who benefit from your success

- Customers or clients: In some cases, key clients may be willing to prepay, invest, or co-create a solution with you

How to attract the right partner:

- Know your numbers and business model

- Be clear on what you’re offering in return (equity, profit share, etc.)

- Look for people aligned with your vision and values

- Protect your interests with a legal agreement

Best for:

Growth-stage businesses with a clear plan and something to offer in return.

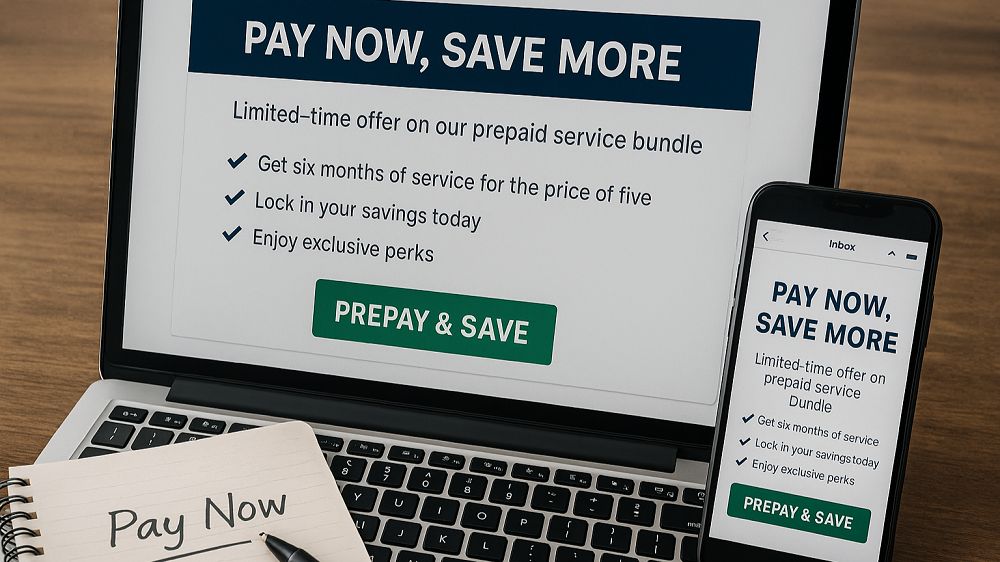

Option 6: Sell Prepaid Packages or Subscriptions

If you offer a service, one of the fastest ways to generate upfront cash is to sell prepaid bundles, gift cards, or subscriptions.

Examples:

- 3-month service bundles

- Loyalty packages with a discount for early payment

- Monthly memberships or retainers

- Product preorders with bonuses

This strategy helps improve cash flow while strengthening customer commitment.

Best for:

Consultants, service providers, health/wellness professionals, and niche e-commerce.

Option 7: Use a Business Credit Card Responsibly

A business credit card is not a long-term funding strategy, but it can help you smooth over short-term expenses.

Look for cards that offer:

- 0% intro APR offers

- Cashback or points on business purchases

- No annual fees

- Expense tracking and integration with accounting tools

Use with caution:

- Avoid carrying high balances

- Pay off in full whenever possible

- Don’t use for payroll or inventory if you can’t cover it within 30 days

Business credit cards are best for managing day-to-day expenses and building credit history.

Option 8: Consider Microloans or Community Lenders

If traditional banks are out of reach, microloan providers and community lenders may offer more flexible terms and support.

Resources include:

- Kiva: Offers 0% interest microloans up to $15,000

- Accion Opportunity Fund: Focused on underserved small business owners

- Local CDFIs (Community Development Financial Institutions): Nonprofits that offer loans to small businesses in specific regions or industries

Benefits:

- Lower credit requirements

- Supportive application process

- Often paired with business mentoring or education

Best for:

Startups, minority-owned businesses, or businesses in low-income areas.

Option 9: Lease Instead of Buy

Freeing up cash by avoiding big purchases is another smart way to manage funding.

Instead of buying:

- Equipment

- Vehicles

- Technology or software licenses

Consider leasing or renting, especially if you only need something for a short time or want to preserve working capital.

This keeps your money available for other priorities while giving you flexibility.

Final Thoughts: Be Strategic, Not Desperate

Trying to fund your business without a bank loan isn’t just about finding money. It’s about finding the right kind of money that aligns with your goals, values, and risk tolerance.

Start by understanding how much you need and why. Then explore the options that give you the most control and the fewest long-term headaches. You may find that the right funding path isn’t a loan at all.

The more creative and resourceful you are, the more options you’ll uncover.