Financial ratios play an important role in measuring the financial health of your business. They are particularly important to lending institutions looking to extend credit. Most lending institutions use a criterion that helps them determine the financial health of a business. If your business is considered to be financially healthy, it can be much easier to secure funds.

However, not all business owners have a sufficient understanding of financial ratios. That’s what your finance manager is there for, right?

Not necessarily.

It always helps to understand the variables connected to the financial health of your business. If your financial ratios aren’t looking too good, then you may have to make some tough decisions. These decisions will be more effective if you understand how they improve your financial ratios and contribute to your business’ financial health.

Let’s take a look at the different types of financial ratios and how you can interpret and improve them.

1. Liquidity Ratios

Liquidity ratios measure the ability of a business to meet its short-term obligations. As such, liquidity is a key indicator of financial health. This is because if a company is unable to pay its short-term debts, then it will have to raise money by selling its assets (likely incurring a further loss). It can also make the company vulnerable to mergers and acquisitions.

There are two major liquidity ratios. These are your Current Ratio and your Quick Ratio.

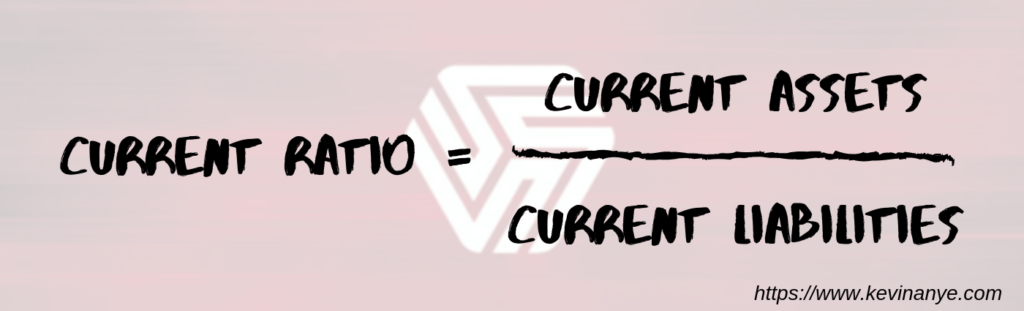

Current Ratio

The Current Ratio is a measurement of your ability to pay your debt based on your Current Assets.

To calculate your Current Ratio, simply divide your Current Assets by your Current Liabilities.

If your Current Ratio is higher than 1.0, then you probably don’t have to worry too much about the liquidity of your company. This is because your available assets are greater than your short term debt (i.e., what you owe in the next year). Ideally, your Current Ratio is closer to 2.0 which indicates that you’re in a much more secure position.

However, simply relying on this ratio isn’t enough. That’s why we also have the Quick Ratio.

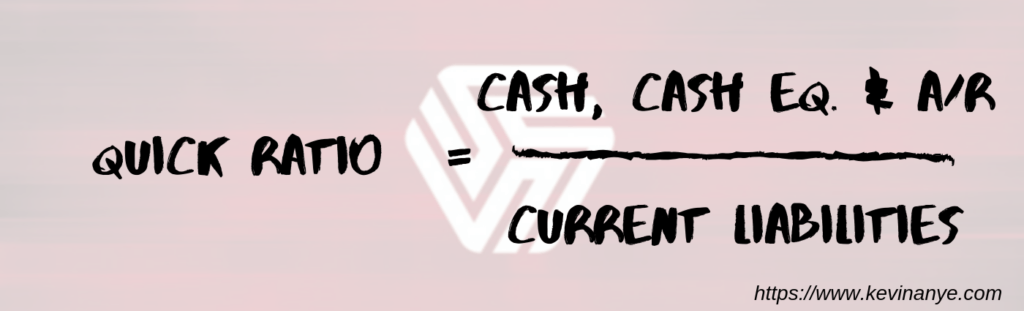

Quick Ratio

The Quick Ratio is a measurement of your liquidity in terms of the cash you have available. This is a better indicator of your ability to pay your debt because it only includes liquid assets.

To calculate your Quick Ratio, divide your Cash, Cash Equivalents and Accounts Receivable by your Current Liabilities.

As an example, if a large portion of your current assets is made up of inventory, then your Quick Ratio will be lower than if those assets consisted of cash or cash equivalents. This is likely a sign of poor inventory management. Unsold inventory may also mean that there is a relatively low demand for certain products.

To improve your financial ratios related to liquidity, you should take a number of steps:

- Analyze your short term liabilities to make sure that the debt you’re incurring is justified. If you don’t need to incur an expense, don’t.

- Monitor your inventory level and assess whether or not it’s being managed effectively.

- Run promotions and consider offering a sales discount on your products to reduce inventory and generate income.

2. Debt Ratios

Debt Ratios (also known as Solvency Ratios) focus on the long-term financial health of your business. They provide insight into the financial structure of your business and measure your liabilities against your shareholder’s equity.

There are two types of financial ratios that are considered here. These are the Debt-To-Equity Ratio and the Interest Coverage Ratio.

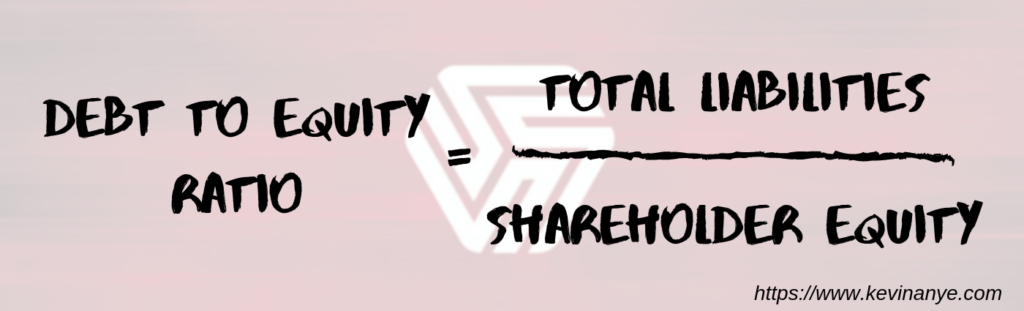

Debt-To-Equity Ratio

The Debt-To-Equity Ratio is a measure of the relationship between your debt (the amount of money borrowed for capital) and your equity (the amount of money provided by your shareholders).

To calculate you Debt-To-Equity Ratio, divide your Total Liabilities by your Shareholder Equity.

The higher the ratio, the more aggressively you’ve been financing your growth with debt.

Unlike the liquidity ratios, a high value for a Debt-To-Equity Ratio is not a good sign. It means that your capital structure relies more on debt than it does on equity. This is a risk factor for lending institutions as it indicates that a company will likely not be able to meet its long-term debt obligations. You should consider revising your capital structure in this case.

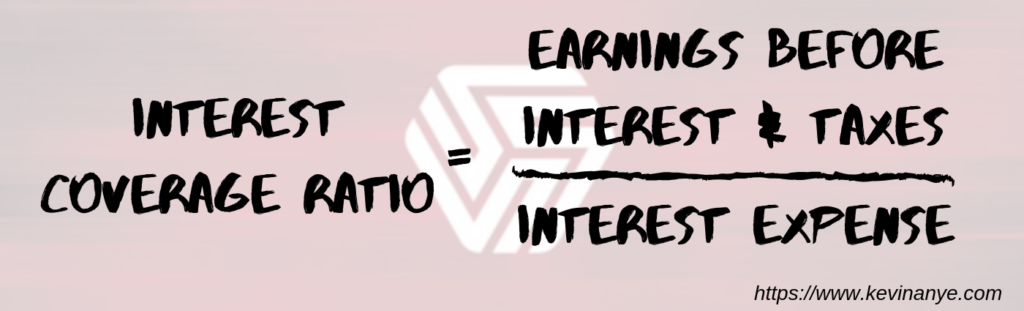

Interest Coverage Ratio

The Interest Coverage Ratio is a financial ratio that factors in your operating income and your interest expense. This ratio is also referred to as the Times Interest Earned Ratio. It helps measure a company’s ability to make interest payments through its operating income.

To calculate your Interest Coverage Ratio, divide your Earnings Before Interest and Taxes (EBIT) by your Interest Expense for the same time period.

Your Interest Coverage Ratio should be at least 2.0 or higher. If it is lower than 2.0, then this is an indicator that your company is not earning enough through its core operations. Naturally, lending institutions will be skeptical towards extending you any further business loans. A low-Interest Coverage Ratio will mean that the chance of defaulting on a loan is higher.

This makes you a risky creditor.

An insufficient operating income is a sign of low profitability, low product demand, and/or poor management overall. You will have to undertake some significant corrective measures to improve your financial ratios in this case.

For instance, if the problem is in your management, then you should consider getting more skilled individuals on board.

Read also: Why You Should Always Hire Overqualified People

You should also conduct an analysis regarding the demand for your products and identify the factors responsible for low demand. This includes an analysis of your competitors, your current promotional strategies, the buying behavior of your target market, etc.

3. Efficiency Ratios

Efficiency ratios are a measure of how your business is utilizing its fixed assets and working capital. This is a direct reflection of the effectiveness of your management. There are two types of efficiency ratios. These include your Asset Turnover Ratio and your Inventory Turnover Ratio.

Understanding each of these is critical to learning how to improve efficiency ratios.

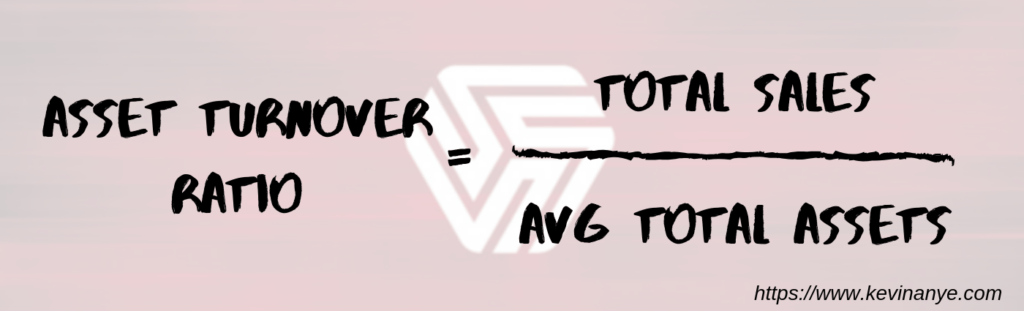

Asset Turnover Ratio

Your Asset Turnover Ratio is a reflection of the company’s efficiency in utilizing its assets to produce the products that it sells.

Calculate your Asset Turnover Ratio by dividing your Total Sales by your average Total Assets for the same time period.

Acceptable ratios vary by industry, but generally speaking, the higher the ratio, the better.

For example, if XYZ Company owns $100,000 in assets, and generates $300,000 in sales, then its Asset turnover ratio is exactly 3x. This means that the company can use its assets to produce and sell products that are three times more in value. Such a company is highly efficient in using its assets.

On the other hand, if you have a company that owns $100,000 in assets and generates $100,000 in sales, the Asset Turnover Ratio is only 1x. The company is producing and selling products that are equivalent to the value of its assets. While this may also be an efficient company, there is much more room for improvement.

A low Asset Turnover Ratio is a potential indicator of poor asset management. It can indicate that you have acquired some unnecessary fixed assets that do not match the production capacity of your company. It can also indicate that you are not operating at full capacity and are not utilizing your assets as well as you should be.

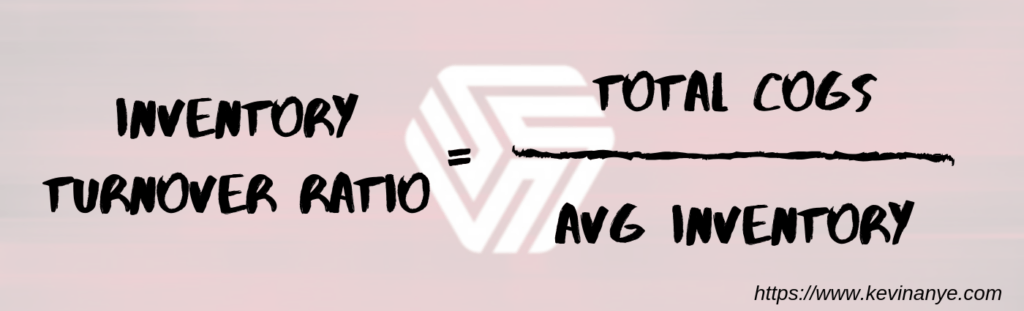

Inventory Turnover Ratio

The second efficiency ratio is the Inventory Turnover Ratio (often referred to as “Inventory Turns“). This ratio is a measure of the company’s efficiency in terms of its inventory cycle. It shows how much inventory a company is holding as well as the speed at which this inventory is sold and replaced by a new batch of products.

To calculate your Inventory Turnover Ratio, divide your average Cost of Goods Sold (COGS) by your average Inventory Investment for the same time period.

Every company aims for a high Inventory Turnover Ratio. This is a sign that your products are selling well and you are generating sufficient revenue in sales.

Be wary of too high of a number, though. If your turns are too high, you likely are not carrying enough inventory to fulfill your customers’ needs. To be safe, always monitor your fill rates very closely to make sure you strike the right balance.

Slow-moving inventory is not a good sign. As mentioned earlier in the section where we discussed the Quick Ratio, this is an indicator of poor inventory management and/or low product demand. It can also be a sign of ineffective marketing and distribution.

Read also: Inventory Management Techniques For Effective Inventory Planning

4. Profitability Ratios

Profitability ratios are a bit similar to efficiency ratios. These ratios help you determine whether your business operations are effective enough to generate profits.

There are three types of financial ratios that help measure profitability. These are the Return On Assets Ratio, the Return On Equity Ratio, and the Profit Margin.

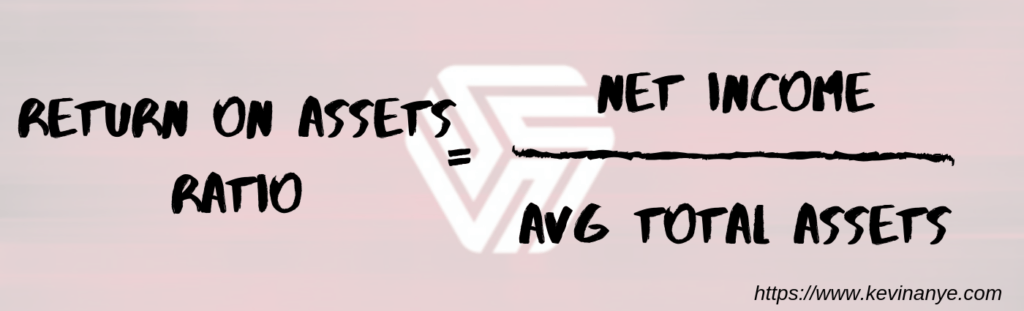

Return On Assets Ratio

The Return On Assets Ratio helps determine how much profit the company is generating through its assets. To put it simply, you are able to determine exactly how much net income you are earning through your assets.

To calculate your Return On Assets Ratio, divide your Net Income by the average of your Total Assets for the same time period.

Remember, your net income is completely different from your revenues. It is the value you get after all operating expenses, taxes, and interest amounts have been subtracted from your revenue.

A company may generate a lot of money in revenues, but if it’s operating expenses are equally high, then its net income will be low. In the end, profits are the most important metric in most business decisions.

It can also be said that this ratio provides a deeper insight into the results obtained from the Asset Turnover Ratio. It helps you understand how much you are actually earning.

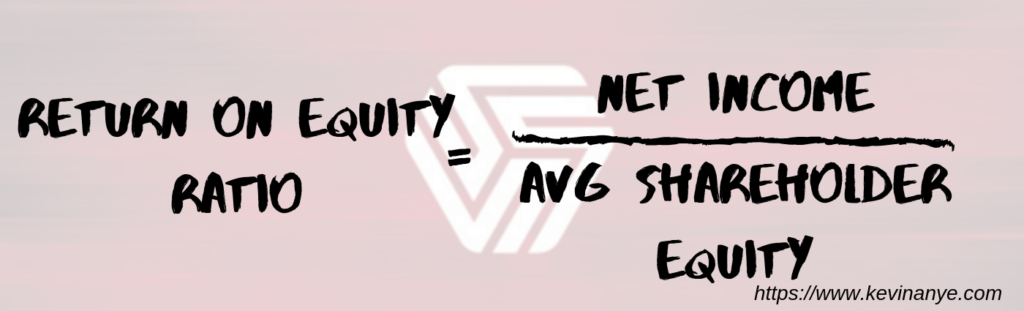

Return On Equity Ratio

The second profitability ratio is the Return On Equity Ratio. This ratio measures the amount of profit a company is generating for its shareholders.

To calculate your Return On Equity Ratio, divide your Net Income by average Shareholder Equity for the same time period.

Naturally, a high return on equity means a high return on investment for your shareholders and vice versa.

Profit Margin

The last profitability ratio is your profit margin. This is a simple ratio that measures your Net Income compared to Total Sales.

Standards vary by industry, of course, but high profits will result in a high-profit margin and indicate that your business is in good financial standing. A low-profit margin is an indicator of low pricing, high operating costs, and/or insufficient revenue generation.

In order to improve your financial ratios related to profitability, you need to reduce or eliminate all unnecessary operating costs and boost your gross profit margin. The opportunities to do so are too many to list, but a detailed analysis of both your costs and pricing structure is a great start.

Read also: 4 Cost Reduction Strategies That Will Grow Your Profits Exponentially

Final Thoughts

There are 4 major types of financial ratios. These can help quantify the liquidity, solvency, efficiency, and profitability of your business. The importance of these ratios is not limited to how they are used by lending institutions and investors as well.

Examining and basing your financial decisions on these ratios can help your business sustain itself in the long run. It can help you avoid financial hurdles, such as losing investors and/or bankruptcy.

Most importantly, improving your financial ratios can dramatically improve the overall value of your business.